A railroad strike or lockout that could take effect Friday has put on deck the potential for historically significant supply chain upheaval that would affect every trucking mode to some degree.

The trucking industry is freight rail’s largest customer and rail moves more than 40% of all long-distance freight in the U.S. As such, a nationwide shutdown of rail service "could be a polar vortex-level shock to the freight market, where supply chains are disrupted over a wide geographical area like we saw in March 2021," said Dean Croke, principal industry analyst at DAT Freight & Analytics.

"I would say polar vortex 2021 bad if the strike lasts about a week," added Jason Miller, Interim Chairperson and Associate Professor of Supply Chain Management in the Department of Supply Chain Management, Eli Broad College of Business at Michigan State University, referencing the particularly harsh winters last year. "But," he added, "COVID-19 bad if we get to two-plus weeks."

Work on a new labor deal has been ongoing for more than two years. Rail providers and 12 employee unions are currently warring over new contracts that call for wage increases and quality of life improvements, among other concessions. The majority of the union groups have agreed to a tentative deal but it will take all 12 to formally stand down a strike.

The Association of American Railroads projects lost economic output due to a national rail shutdown could be more than $2 billion per day, and more than 460,000 additional long-haul trucks would be needed every day to offset the loss of rail capacity – a scenario that is impossible on almost every conceivable level.

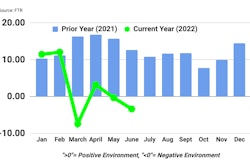

There's some good news in that, particularly for spot market carriers. "Today, spot rates have been falling for eight months," Croke said. "A prolonged strike could send spot rates back upward as shippers scramble to move their freight. Given that it’s RFP season, the tail end of peak shipping season, harvest season and there’s a lot of uncertainty over consumer spending during the holiday season, a strike would be more devastating to shippers than anyone. If I’m a carrier, I’d be communicating with customers and evaluating their exposure to service slowdowns and a potential strike right now."

Some national rail service providers and a number of regional railroads began reducing service as of Monday, and the loss of rail capacity for an extended period will spur a "sharp increase in dry van long-haul shipments from both coasts inland," Miller said.