While U.S.-based supply chains are out of sync they are also facing rising costs, according to the 2022 State of Logistics Report. The annual report is produced for the Council of Supply Chain Management Professionals (CSCMP) by consulting firm Kearney and presented by Penske Logistics. It was unveiled Tuesday at the National Press Club in Washington, D.C.

Last year's report noted the effects of the pandemic on the supply chain and the 2022 report found that residual challenges of the pandemic remain, with some disruptions continuing to deliver damaging effects on capacity.

The 2022 report notes that e-commerce sales grew 10% last year (to $871 billion), accounting for 14% of U.S. retail sales. Trucking freight continues to see more volume and opportunities. With road freight accounting for the largest segment of the U.S. supply chain spend, it expanded by 23.4% to $831 billion.

The sudden growth and demand of the last-mile delivery system taxed and further exposed an already insufficient labor supply and overburdened infrastructure, the report found, causing pricing spikes, capacity shortages and some acute logistical challenges. Amazon accounted for 21% of all U.S. parcel volume and raised pay for drivers and other hard-to-fill positions.

UPS saw demand outstrip its capacity by as much as 5 million parcels per day and raised rates by 5.9% in 2021, as did FedEx. Other firms pursued capacity via acquisition, like Maersk’s $1.7 billion purchase of Pilot Freight Services in February. In the U.S. logistics sector, 2021 was a record year for mergers and acquisitions.

"We have seen an incredible amount of resiliency among private truck fleets and dedicated contract carriage truck fleets," said Andy Moses, Penske Logistics senior vice president of sales and solutions. Demand has been up sharply year-over-year and these fleets continue to manage the complexities they face in the trucking supply chain including headwinds caused by shortages of parts, equipment, drivers, and most recently rising fuel costs."

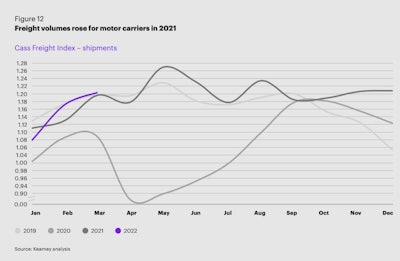

Motor carriers registered a healthy rise in freight volumes in 2021, as total shipments mostly matched or exceeded pre-pandemic levels throughout the year.

Motor carriers registered a healthy rise in freight volumes in 2021, as total shipments mostly matched or exceeded pre-pandemic levels throughout the year.