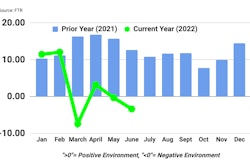

Class 8 net truck orders reached 21,600 units in August, according to preliminary data released by ACT Research, a signal that "in spite of increased economic uncertainty, carrier profitability and unmet demand continue to support activity," said Eric Crawford, ACT’s Vice President and Senior Analyst.

In July, order activity was the weakest for the month since 2019 with OEMs essentially out of build slots for this year. Too, ongoing supply chain disruptions are limiting 2022 output and the fluctuating cost of materials and components has caused delays in confirming orders for shipment next year.

August's order intake reflects a 98% improvement over July and FTR Vice President of Commercial Vehicles Don Ake noted that most OEMs have started taking a limited number of orders for the first quarter of 2023 and it appears OEMs have returned to the pattern of the first quarter of this year when orders averaged 21,100 units.

“The good news is that the traditional summer order slump has ended a month early this year," Ake said. "OEMs felt the need to start filling in their Q1 production schedules for their prime customers. The supply chain is still cogged so they still are unable to book all the commitments they still have.”

Crawford noted that using preliminary August orders and the corresponding OEM build plans from ACT's August State of the Industry: NA Classes 5-8 Vehicles report (July data) suggest, "the Class 8 backlog should fall by around 8,900 units when complete August data are released (less than the 12,400 average decline the prior 3 months)," he said.

Ake expects order totals to jump in the coming months when all OEMs fill all the first quarter build slots, adding "the needs of the fleets still greatly outnumber the production capacity of the OEMs under the current restrictions.”