A new company has emerged to offer small freight operators free factoring for loads and more through an all-in-one fintech platform.

Seattle-based Outgo, which recently completed a $3.4 million funding round, automates broker setups, invoicing, factoring, collections, accounting and tax services without contracts or minimums. It aims to modernize how carriers with 10 or fewer trucks control their finances in a world where small fleets and owner operators, now more than ever, are finding work while legacy finance solutions have been slow to adapt to their needs.

Outgo charges a maximum daily rate of 1.5% – and less if a carrier is only accessing the cash when needed – as opposed to the typical 3%, and the company claims most all carriers will have an actual factoring rate that is significantly less than 1.5% when using Outgo's on-demand factoring.

Outgo charges a maximum daily rate of 1.5% – and less if a carrier is only accessing the cash when needed – as opposed to the typical 3%, and the company claims most all carriers will have an actual factoring rate that is significantly less than 1.5% when using Outgo's on-demand factoring.

“We thought there was a unique opportunity to serve (carriers) because they're the backbone of the American economy: 95% of carriers operate 10 or fewer trucks, and most are independent owner ops,” Womack said. “Carriers care about two things: finding work and getting paid. In the last decade … there has been a lot of help finding work (for carriers), but the financial challenges of getting paid have been largely left unaddressed.”

He said it leaves carriers with a patchwork of expensive, antiquated financial services that are “kind of clumsy to operate across their back-office workflow.”

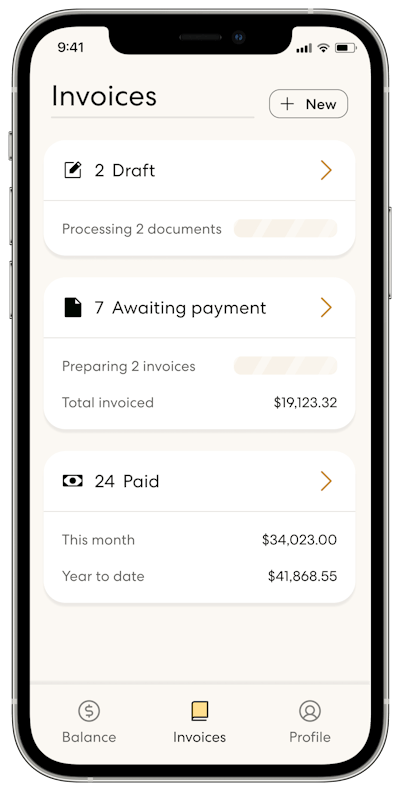

Outgo is a smart-banking platform that connects invoice management with a debit card that allows carriers to factor for free. Womack said one out of two loads end up being factored.

With Outgo, a carrier’s invoicing and factoring processes, bank accounts and all expenses are connected in one place. Carriers can load their documents into the platform, and they don’t have to factor until they need the funds, which saves them money.