Trailers. Manufacturers are struggling to build them but fleets continue to line up for them.

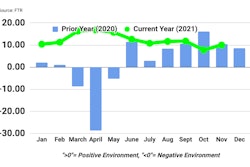

Fleets booked orders for just more than 26,000 trailers last month, according to ACT Research – a pace comparable to December – but 17% lower than last January. January orders is more a reflection of the level trailer manufacturers are willing to accept than a reflection of demand.

Frank Maly, director of commercial vehicle transportation analysis and research of ACT Research, said OEMs continue to carefully manage order intake in an effort to control the length of their production commitments, adding that January’s net order volume matching December’s intake is evidence of that effort.

FTR Vice President of Commercial Vehicles Don Ake noted the commercial trailer industry is "remarkably steady right now," as "production has basically flatlined for nine months and now January orders are equal to December. The supply chain failures have created one of the most stable environments in the history of the industry," he added. "OEMs are not confident about getting more parts and components in the future, so they are not yet booking all the fleet commitments into the backlog."

U.S. trailer industry backlog grew 3% sequentially in December, according to ACT Research, but ended 2021 9% below the previous year.

The industry backlog stretched through August, on average, at the start of the year, Maly said, and January reports point to a closing backlog that could extend into September, "with dry van and reefer commitments likely reaching early into the fourth quarter," Maly said. "The dry van category closed 2021 with an 8.7-month backlog-to-build, while reefers – normally the category with the industry’s longest backlog – ended 2021 at 8.3 months. Surprisingly, the long horizons occurred in the vocational categories, with heavy lowbeds currently stretching into early Q2’23 at current production rates.”