Something weird is happening in the economy, and with trucking so often a canary in the economic coal mine, commentators have rushed to predict, or even declare, a freight recession as a precursor to a wider whole-of-economy recession.

In early April, predictions of a "trucking bloodbath" were everywhere, as spot van and reefer freight rates fell off all-time highs and diesel prices were on their record-breaking jaunt well past $5/gallon, and eventually to $6. Since then, the S&P 500 and Dow have both tumbled around 10% while core inflation, which even excludes food and fuel, has ballooned a whopping 9% year over year, according to the latest data. All of it carries consumer inflation expectations, and generally poor everyday economic sentiment that can create something of a self-fulfilling prophecy.

But despite investor losses and consumer pain, the U.S. isn't in a recession. While, colloquially, people say a recession means two consecutive quarters of negative GDP growth (we'll get some idea of Q2 on July 28), it's technically declared by the National Bureau of Economic Researchers, a private nonprofit that looks at a variety of factors before dropping the dreaded R word.

But tell that to a family that just bought groceries and filled up the family midsize crossover for more than $100. Tell it to the owner-operator who just filled up for a grand, is paying too much on a used truck, and is looking at spot loads for south of $2.50/mile just a few months after they might have been moving at $3.50.

Spot rates have indeed fallen, but remain fairly high historically. Supply chain issues have indeed snarled availability of everything from DEF and motor oil to parts and diesel itself, but freight volumes remain up. Diesel stands at a towering $5.42/gallon nationally as of July 18, but freight spending has grown, too.

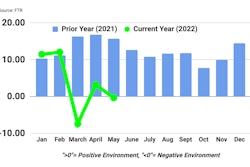

The U.S. Bank Freight Payment Index, for instance, shows that overall spending on freight has reached new highs with the cost of fuel, the shipment index has leveled out at where it was in Q4 of 2021. For the current period, it is down year-over-year, the summer still holds an elevated level on track with last Christmas.U.S. Bank Freight Payment Index

The U.S. Bank Freight Payment Index, for instance, shows that overall spending on freight has reached new highs with the cost of fuel, the shipment index has leveled out at where it was in Q4 of 2021. For the current period, it is down year-over-year, the summer still holds an elevated level on track with last Christmas.U.S. Bank Freight Payment Index

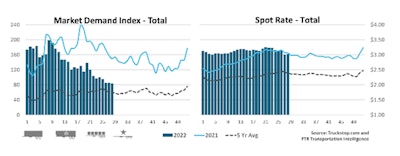

Spot market demand, meanwhile, has been falling by and large since the beginning of the year, with rates losing ground even as fuel costs have risen. That's according to metrics tracked in a partnership between Truckstop.com and FTR -- their most recent update for the week of July 18 is shown here.Truckstop.com/FTR Transportation Intelligence

Spot market demand, meanwhile, has been falling by and large since the beginning of the year, with rates losing ground even as fuel costs have risen. That's according to metrics tracked in a partnership between Truckstop.com and FTR -- their most recent update for the week of July 18 is shown here.Truckstop.com/FTR Transportation Intelligence