Trucking news and briefs for Thursday, Jan. 26, 2023:

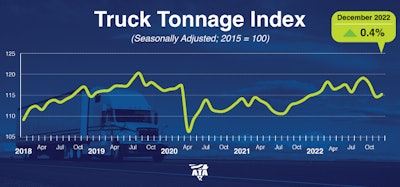

ATA's Truck Tonnage Index for December increased by 0.4%.ATA

ATA's Truck Tonnage Index for December increased by 0.4%.ATA

“Despite the small gain in December, for-hire truck tonnage clearly decelerated during the final quarter in 2022,” said ATA Chief Economist Bob Costello. “In fact, tonnage outperformed some other key metrics that drive truck freight, like housing starts and factory output during the final month of the year. This is probably because contract truckload freight is still outperforming the spot market and less-than-truckload freight after underperforming both of those sectors in 2021.”

For all of 2022, tonnage was up 3.4%, which was the best annual gain since 2018. “Despite weakening in the second half, 2022 overall was a solid year for truck freight tonnage,” Costello said. “The index’s yearly gains were primarily driven by strength in the first half of 2022, so despite a marked slowdown as the year ended, for the year as a whole, tonnage posted a very solid year overall.”

Compared with December 2021, the SA index increased 0.3%, which was the sixteenth straight year-over-year gain, but the smallest over that period. In November, the index was up 0.8% from a year earlier.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by fleets before any seasonal adjustment, equaled 112.6 in December, 1.8% below the November level (114.6).

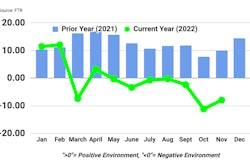

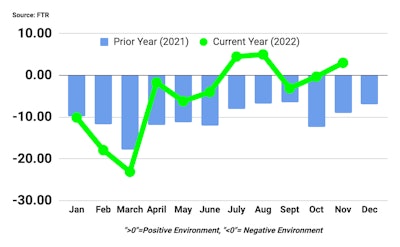

Shippers' conditions returned to positive territory in November after two months in the negative.FTR

Shippers' conditions returned to positive territory in November after two months in the negative.FTR