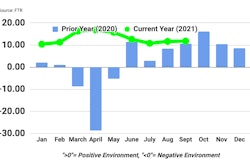

Net trailer orders in October plummeted 40% – 16,700 units according to preliminary data released by ACT Research – and were off 70% from last year’s peak order month. Final October volume will be available later this month.

Frank Maly, ACT Research director of commercial vehicle transportation analysis and research, noted ongoing market uncertainties have prevented OEMs from kicking off their normal order season and fleets have responded accordingly. Also, he noted, a tough October 2020 comparison as it was the second-highest net order month in industry history "when fleet investment plans rebounded from the spring COVID doldrums.

"Challenges of supply-chain bottlenecks, labor shortages and material and component prices are forcing OEMs to proceed very cautiously,” he said. “Initial reports indicate that October build rates were similar to September. So OEMs, while able to maintain production levels and manage backlog horizons, continue to be unable to ramp efforts to meet the extremely strong and growing fleet demand for additional trailers.”

Don Ake, FTR director of commercial vehicles, noted few OEMs booked decent order totals, but most held back on slotting 2022 commitments due to uncertainty about production capability, especially in the first three months next year. The major OEMs, he said, are rolling unbuilt 2021 orders into 2022 and filling any gaps with new orders.

"Orders have been tepid all year. The challenge for many OEMs is not to acquire more backlog, but to manage the backlog they have. Fleets need lots of new trailers, however, the manufacturers are being careful about how and when to slot these commitments into the build schedule," Ake said.

Some OEMs that are booking orders beyond Q1 2022 are adding material surcharges in order to price trailers fairly due to commodity prices that are high and volatile.

"Fleets do want to get their orders scheduled for next year, but that may happen only a month or two at a time," Ake added. "October is the traditional start of the fall ordering season for the following year. However, this is far from a normal year. Orders will remain constrained until the supply chain permits OEMs to complete their bookings for 2022. Order numbers continue to understate the true demand.”

Maly aded that he expects order acceptance to be closely managed for the foreseeable future, "with OEM challenges including the current strong backlogs that commit many of them for a major portion of next year and their inability to ramp production volume in response to surging fleet demand.”

Trailer orders for the past 12 months total 277,000, according to FTR.