Net trailer orders in the U.S. reached 25,444 units in June, according to data released by ACT Research – 31% higher compared to May and nearly 122% above the year-ago.

Order placement remained choppy in June as dry van and bulk tank net orders sequentially increased by double digits over May but reefers and flatbeds saw double-digit declines.

"OEMs continue to negotiate with fleets, and as some 2023 order boards have opened, those efforts are quickly moving from staged/planned orders to booked business," said Jennifer McNealy, ACT Research director of CV market research and publications.

While some OEMs have opened part of their 2023 build slots, McNealy said discussions indicate that others are holding to their plans to wait a bit longer as manufactures continue to face supply-side challenges, limited material availability and labor problems.

"Demand remains strong, despite increased pricing," she said, "and cancelations, although ticking upward, are insignificant, as fleets in queue need the equipment and plan to stay in queue until orders are converted to deliveries. The industry closed June with a 7.6-month backlog-to-build ratio, which commits the industry, on average, into early 2023.”

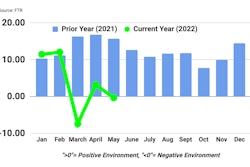

June's final order intake was notably higher than preliminary estimations as the industry enters summer months where numbers traditionally decline. This year, order tabulations are somewhat unique as OEMs can't build trailers fast enough and are limiting how many orders they will accept on a month-to-month basis, said Don Ake, vice president of commercial vehicles at FTR.

“The OEMs are holding onto an enormous amount of fleet commitments for 2023," Ake added. "Unstable commodity costs and other variables make quoting prices difficult right now. However, these commitments should begin turning into booked orders beginning in September, and there is the potential for record order volumes in the fourth quarter.”