Despite component and material shortages inhibiting trailer manufacturers from building units at a pace that meets demand, November net U.S. trailer orders hit 32,103 units – up more than 84% from the previous month.

Before accounting for cancellations, new orders of 33,900 units were up more than 73% versus October, but 18% lower than the previous November, according to ACT Research.

Frank Maly, director of commercial vehicle transportation analysis and research at ACT Research, noted there were concerns that more 2021 commitments might need to be shifted into 2022, resulting in an additional surge in cancels. "It now appears that most of that adjustment occurred in September, and excluding September," he said, "the industry has had an average 1.0% cancel rate since May.”

The increase in order activity was mainly a result of large fleets placing 2022 orders and OEMs having the confidence of entering them into the backlog, said Don Ake, FTR vice president of commercial vehicles.

"This is great news for the trailer market. Fleets are signaling they will need considerably more trailers in 2022 to handle the freight growth and relieve some of the pressures in industry capacity and the spot markets," Ake said. "It also indicates the OEMs are beginning to look forward beyond Q1 and expect to be able to lift build rates at some point. Orders have been under the 30,000-unit mark for nine months, so this is an impressive number in that regard.“

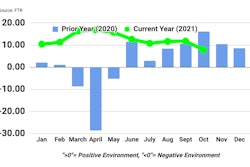

Net orders year-to-date and new orders for the first 11 months of 2021 were both about 11% lower compared to the same time period in 2020, which included the COVID-stricken spring data.

“Trailer OEMs continue to be cautious regarding order acceptance, as they attempt to maintain acceptable delivery schedules given their available staffing and anticipated supply-chain support,” said "The difficulty of developing pricing in the current inflationary market conditions also impacts order acceptance. OEMs are attempting to avoid the renegotiation cycles that occurred earlier in 2021, and the best way to achieve that is to extend their orderboards in small steps as the year progresses.”

Maly said he expects trailer OEMs to continue closely managing backlogs, which now edge into the second half of 2022 at current build rates.

"There is still much uncertainty as we enter 2022. Some OEMs are still reluctant to enter orders too far in advance under these conditions," Ake aded. "Quoting prices for future sales remains a challenge and some OEMs are employing surcharges and other tactics to manage new orders and total backlog. Therefore, the November orders indicate that progress is being made. When there is enough certainty and confidence about 2022, orders should rise accordingly.”