"The reports of my death are greatly exaggerated." – A phrase originally uttered by Mark Twain but also applicable to the perceptions of the current freight market.

A sharp and extended pullback of spot market rates, coupled with a surge in the price of diesel fuel, has sounded alarm across pockets of the industry, but that concern hasn't yet widely trickled down to fleets, many of which are still standing in line for new equipment that truck and trailer OEMs simply cannot build fast enough.

ACT Research Vice President Steve Tam said just more than 11,000 Class 8 truck orders have been canceled this year versus an order intake of about 64,000 over the first three months of 2022, and just under 4,000 trailers compared to orders of more than 91,500. March's trailer cancelations were the lowest this year, according to Tam, while truck cancellations dropped 1,500 units from February highs.

"While it might not be completely obvious, cancellation activity is essentially a non-issue," Tam said. "Most of the activity is actually the OEMs performing housekeeping – that is, cancelling orders for previous model year equipment and replacing the order with a corresponding new order. Simply put, demand remains solid, not impacted by the current slowing freight growth environment. Freight is still growing, just at a slower rate. In the near term, the decline is from historical highs. Relative to the longer term, growth remains intact."

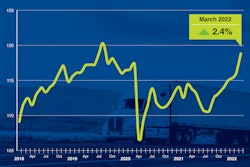

Source: ACT Research

Source: ACT Research

Fleets have been waiting to get enough new equipment for over a year, noted Don Ake, FTR's vice president of commercial vehicles. "To cancel and get out of the waiting line at this point, with pent-up demand so high, doesn't make much sense," he said, estimating pent-up demand for trailers alone to be as high as 100,000 units.

"Yes, freight has eased off from the robust growth we saw coming out of the economic restart, but freight volumes continue to grow," Ake added. "FTR is forecasting Class 8 freight growth to remain at healthy levels this year and still be just under 3% next year. Of course, there are risks to this forecast, and if the economy eventually goes into recession, it would probably take the freight markets with it."