When Jennifer Rumsey was named Cummins President and CEO last year, the century-plus old manufacturer of diesel engines was already in the process of remaking itself. Now, seven months later, she's leading the company's evolution from a provider of diesel power solutions that Cummins invented to a provider of multiple green power alternatives.

Cummins earlier this year introduced its fuel-agnostic 10-liter engine for launch in North America in 2026. Positioned to replace both the L9 and X12, the bi-voltage X10 will roll out first as a diesel-fueled variant intended for both medium- and heavy-duty applications.

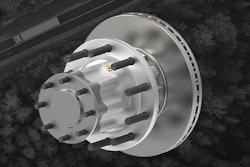

Cummins last year acquired Meritor for more than $3 billion, drawn to the company at least in part by its electric powertrain solutions. Cummins had been on the hunt for acquisitions in the emission-friendly space, having in 2019 closed a deal to acquire fuel cell systems provider Hydrogenics and last year picking up a 50% interest in Momentum Fuel Technologies, a natural gas (CNG) fuel system solution for Class 6-8 vehicles co-owned by Rush Enterprises.

Those acquisitions help insulate Cummins from a transformative time in transportation that looms ahead. "You can see a future where the need for engines will decrease," Rumsey said, speaking at the Green Truck Summit in Indianapolis Tuesday morning. "We've done five different acquisitions focused on our New Power Business," Rumsey said.

Cummins' New Power segment was formerly known as the Cummins Electrification Business Unit, and the shift in name reflects the company's shift in strategy; one that will include, yet not be limited to, electrification.

Rumsey noted last year that Cummins invested a record of $1.3 billion in research and technology with an emphasis on decarbonization, adding "we see decarbonization as a growth opportunity for Cummins."

However, that doesn't mean throwing its legacy business away. "We continue to invest heavily in our base engine solutions," Rumsey said, adding the near-term emphasis on Cummins' base business was in decarbonizing it. Cummins acquired Jacobs Vehicle Systems – the grandfather of the Jake Brake – bringing onboard its engine braking and cylinder deactivation technologies.