The state of Connecticut's Class 8-only vehicle miles tax, called the Highway Use Fee, took effect on January 1 of this year with the first reports due at the end of January, and already fleets, owner-operators, and state representatives have voiced confusion and anger on numerous aspects of the new tax.

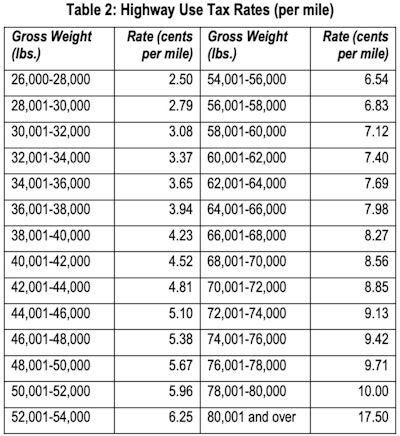

The HUF requires any carrier who operates a combination truck in Classes 8-13 (as defined by the Federal Highway Administration) and weighing 26,000 lbs. or more (aside from some milk haulers) to pay between 2.5 and 17.5 cents per mile traveled on any road in Connecticut. Carriers that do operate eligible vehicles, no matter what state or states they're registered in, must register with Connecticut's Department of Revenue Services (DRS) and file monthly reports to pay the applicable tax.  Connecticut's rate table for all combination-truck gross weights

Connecticut's rate table for all combination-truck gross weights

On February 28, the first tax bill, covering the month of January, came due.

By early March, House Republicans had already proposed a bill to strike down the tax by July 1. In Connecticut's upper house, a Democrat introduced a bill to exempt trucks transporting agricultural commodities and machinery.

Dave Palumbo, owner of 100-truck dry bulk hauler Palumbo Trucking, told the state legislators he'd paid around $5,000 in HUF for January alone.

[Related: Trucking groups sound off as Connecticut truck VMT tax signed into law]

Interviewed more recently, he estimated his company was looking at a total outlay of "$150,000 to $170,000 for the cost of the tax and the overhead, plus the employee I had to hire to calculate it and cover all the mileages every day and compute the tax."