Trucking news and briefs for Thursday, July 2, 2020:

YRC expects to receive $700 million CARES Act loan

YRC Worldwide (No. 5 on the CCJ Top 250) announced Wednesday that the U.S. Treasury Department intends to loan the fleet $700 million as part of the CARES Act for COVID-19 pandemic assistance. That comes in exchange for nearly 30% ownership stake of YRC by the U.S. government. YRC has been plagued with debt and profitability issues since the recession in 2008-2009.

The fleet says it and its companies Holland, New Penn, Reddaway and YRC Freight “have been significantly impacted by the COVID-19 pandemic.” YRCW plans to use the CARES Act loan to pay for deferred employee healthcare and pension costs and other contractual obligations, as well as to support capital investments.

The Treasury Department will receive 29.6% fully diluted equity ownership in YRCW for the loan. The company will receive the $700 million in two portions:

- The first of approximately $350 million will be used to cover short-term contractual obligations and certain other obligations including pension and healthcare payments. The loan terms are the London Interbank Offered Rate (LIBOR) benchmark interest rate plus 3.5%, consisting of 1.5% cash and 2% payment in kind. This loan matures on September 30, 2024.

- The second portion of approximately $350 million will be used for essential capital investment in trailers and tractors and is expected to carry an interest rate of LIBOR plus 3.5% in cash. This loan also matures on September 30, 2024.

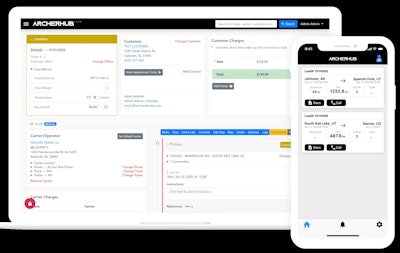

Small-mid-size fleet-focused management system helps automate back office

A new transportation management system called ALVUS, from the Archerhub company (which operates a digital freight marketplace), builds in some artificial-intelligence-enabled technology to help automate back-office accounting and management operations for the small- to mid-size carrier.

More information about Archerhub and its ALVUS management software can be found here.

More information about Archerhub and its ALVUS management software can be found here.It features a cloud-housed dispatch management platform designed to bring a company’s actors together to execute the best dispatch option possible, regardless of office and truck location.

Nick Darmanchev, founder and CEO of Archerhub, hopes the system helps smaller carriers better compete with the big guys. Darmanchev’s competitive in the fleet business himself, and noted he’s “keenly aware of the challenges that owner-operators face in getting bogged down with admin and process. ALVUS was developed specifically to help streamline those processes.”

ALVUS can automatically issue permission for trusted drivers to issue their own Comchecks or EFS checks for a lumper via the driver’s mobile application. When the driver issues a Comcheck, the right journal entry is registered on the accounting ledger, which releases the accountant from entering a manual journal entry, all while freeing the dispatcher from engaging with the driver about the lumper.

Automated billing features take away the need to spend hours matching BOLs and PODs to loads, and streamlined accounting and invoicing processes save time and energy, as well. Payroll functions can simplify processes for those employing drivers or leasing owner-operators, and ALVUS integrates well with both DAT and Truckstop.com for automated truck posts — the system can be set to post available capacity in advance to help secure load opportunities.

![[Screenshot] Distracted Driving Detection86-2020-06-30-16-27](https://img.ccjdigital.com/files/base/randallreilly/all/image/2020/06/ccj.Screenshot-Distracted-Driving-Detection86-2020-06-30-16-27.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)