Over the last few years, the trucking industry has contended with several disruptions to normal operations, like the ELD mandate and the COVID-19 pandemic. The industry is at the crossroads of witnessing yet another disruption courtesy of the shutdown of 3G cellular infrastructure.

Major U.S. cellular providers are in the process of 3G spectrum sunsetting as they phase out all existing 3G infrastructure to expand 4G LTE and the more futuristic 5G network. While individual providers have different deadlines for their 3G sunset, most networks will cease to exist by the end of this year. Shutdowns approaching include AT&T (Feb. 22) followed by T-Mobile (ongoing from March 31 and July 1). Phasing out 3G connectivity is a drawn-out process. With deadlines looming, it’s now or never when it comes to equipping fleets with 4G LTE enabled devices.

The trucking industry has traditionally been sluggish in its reception to technology. However, industry stakeholders in recent years have been more inclined to adopt technology solutions that increase efficiencies and improve bottom lines. Millions of 3G-enabled Internet of Things (IoT) devices now aid trucking operations across the U.S., all of which will stop working beyond 2022.

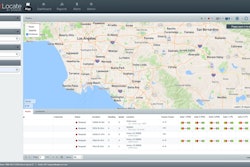

For trucking fleets, the loss of visibility into operations will be significant. Devices and sensors monitoring operations connect to a cellular network to push information to the cloud. The network these devices connect to determines the speed of data transmission. Faster transmission rates result in data being more real-time, helping fleet management leverage insights for improving different operational aspects.

Real-time monitoring of freight movement is increasingly critical today. A granular understanding of real-time shipment and asset status will help carriers determine their fleet utilization levels. In this context, transitioning to 4G LTE makes operational sense as it transfers data at up to 100 megabytes per second — outperforming 3G networks by several hundred times.

Data transmission speed is vital, especially in trucking where video-based insights on in-cab activities and the driving environment are slowly emerging as must-have rather than a "could-need." Devices running 4G LTE can improve over their 3G counterparts by recording and relaying data to the back office much faster, opening up a wide variety of use cases. For instance, real-time fleet monitoring can help fleet managers understand driver behavior and proactively intervene to make improvements.

For fleets transitioning to 4G LTE devices, it is critical to have processes in place to avoid grounding fleets for an extended period of time. The migration is often time consuming, especially for large fleets that operate hundreds or thousands of assets across the country. Planning includes staggering transition across the fleet to ensure utilization levels are not drawn down heavily. Additionally, fleet management may have to train back-office personnel on handling and operating the new devices and back-end systems.

While replacing existing devices is a cumbersome process, companies will do well to initiate the transition as early as possible as trends within the trucking industry point to tightening supply in the wake of more demand for 4G LTE devices. Disruptions to the supply chain – such as COVID-19, ongoing port congestion, the global chip shortage, tight availability and rising costs of commodities like metals and plastic – could mean further deterioration in market availability of 4G LTE devices. The ELD mandate is a glaring example as a large portion of the trucking industry had not adopted ELDs during the run-up to the mandate. Eventually, demand for ELDs shot up with the legislation date around the corner, causing device shortages in the market.

With the urgency behind 3G sunset more subtle than the ELD mandate, it is critical for trucking fleets to begin their transition soon. This will ensure they neither have hiccups with finding devices closer to the full 3G shutdown, nor have visibility blind spots across operations as network providers phase out their infrastructure.

The improved visibility afforded by 4G LTE reflects on increased operational efficiencies by improving asset utilization, dispatch and routing. Accurate estimated time of arrival will enable the fleet to dynamically define operations and tighten logistics workflows while reducing driver and trailer detention times.

While the trucking industry is in the midst of a hot carrier market triggered by insatiable consumer demand, it is tempting for motor carriers to keep their asset uptime high to maximize revenue. However, upgrading the fleet’s hardware to 4G LTE is paramount. Transitioning must be top priority, as the upcoming 3G sunset will inevitably create informational black holes.

William Sandoval is senior vice president of product management and strategy for PowerFleet.