Of particular interest is the mode — the most frequently occurring value in the data set. Also important is the standard deviation of DAT’s rolling 15- and 30-day spot market rate data. Both of these statistical tools help identify early signs of rate volatility.

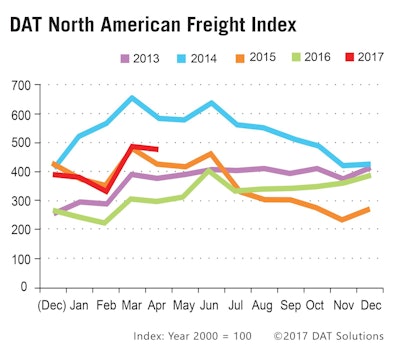

One year ago, the analysis led McHaney and Criss Wilson, vice president of operations at Barton Logistics, to predict that rates would increase dramatically prior to December, 2017, as more carriers came into compliance with the electronic logging device rule.

Pricing would be much higher, they surmised, as ELDs took capacity away from small fleets and owner operators by lowering their utilization. Both now see the predictions were wrong.

“We have learned that quite the opposite of that is happening,” McHaney says. As more carriers implement ELDs, the rates are less volatile.

“(ELDs) are not having any effect right now,” Wilson says. “There is nothing that leads us to believe there is any volatility in the market right now.”

Wilson believes that any rate increases will come from the demand side of the equation, but demand so far this year has been “tepid and anemic.”